Guessing the Line on U.S. Sports Betting

Analysis of Key Factors Shaping U.S. Sports Betting Revenue Potential

There’s no doubt that sports betting is a growth engine for the entire sports industry, but exactly how large the market opportunity will be is a matter of significant debate. At one extreme, the American Gaming Association believes that the black market for sports betting was as large as $150B prior to legalization across parts of the country. More moderate estimates from Gabelli Funds and JP Morgan project the legal market to grow to $8-$9B by 2025. Dave VanEgmond (Founder Bettor Capital) recently tweeted his own prediction somewhere between these ranges, estimating that the U.S. market could be as large as $50B.

Bottom line: Predictions are all over the place.

Rather than throw another number into the ring, let’s take a look at the market through two key factors: unit economics and regulatory considerations. Diving into each of these domains will provide a useful framework for understanding some of the key levers shaping the market, and what you’d need to believe to be true for it to hit various sizes.

Unit Economics:

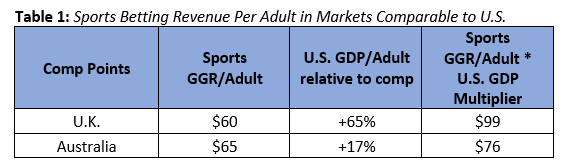

While sports betting is new to the United States, there are preexisting mature markets we can look to as comp points for how the U.S. market may evolve. Two of the best examples are the U.K. and Australia, as they are similar to the U.S. from the perspective of language, laws, culture, and macroeconomics. According to Gabelli Funds, the Sports Gross Gaming Revenue per Adult is $60 in the U.K. and $65 in Australia. For reference, Sports Gross Gaming Revenue refers to the revenue maintained by the sportsbook after subtracting the cost of payouts to winners. Factoring in the GDP discrepancy between the U.S. and each of these markets, and assuming the U.S. sports betting market takes similar shape, that would imply a GGR/Adult between $76-$99. These results are summarized below in Table 1.

It’s also important to point out that New Jersey, one of the leading states thus far in legalization, brought in $398.5M in sports gross gaming revenue off of $6B in total sports wagers in 2020. Given New Jersey’s population of ~8.8M, that implies a 2020 GGR/Adult of $45, well below even the Low case estimate. The GGR/Adult for New Jersey seems more likely to go down than up in 2021 too with pending legalization in New York.

I expect some of you are already taking to Twitter to complain that the U.S. market is still growing significantly and that it has unique properties relative to the U.K./Australia in terms of passionate fans with a high willingness to spend. While I know a number of foreign Premier League and Cricket fans who would vociferously dispute this notion, let’s go ahead and take this assumption at face value-adding in a high case scenario where Sports GGR/Adult is $125.

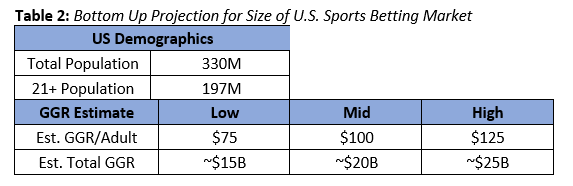

Looking at the results in table 2, for the U.S. Sports Betting market to hit ~$25B market size, you would need to believe that an average of $125 of revenue was generated per every adult 21+. Not totally unreasonable, but for the American Gaming Association’s $150B figure to be true, it would imply a GGR/adult of $750. Even factoring in whales seems like a significant stretch. Even David VanEgmond’s $50B number seems a bit out of reach (although to be fair his tweet may have also been including other game formats such as Daily Fantasy not typically categorized within sports gross gaming revenue).

Regulatory Considerations

If sports betting were a normal market, we’d be ready to put a bow on the market sizing at around $15B-$25B as the most likely scenarios, with some variance in either direction. However, sports betting is unique in the U.S. with respect to the regulatory framework. The 2018 Supreme Court decision in Murphy v. NCAA overturned the federal ban on sports betting and returned rights to the states to determine their own sports gaming laws and regulations. In the absence of federal law, a patchwork of differing regulations has emerged.

Currently, there are 21 states (including Washington, D.C.) that have legalized sports betting (14 of which permit mobile sports betting) and 5 more that have passed legislation and are slated to start operations this year. See Figure 1 below for a visual summary of where things stand, based on Variety’s February report on Sports Betting. The pace of legalization, as well as the types of sports betting allowed, will have a significant impact on how large the wider national market can become.

There are 4 key regulatory considerations interested parties should monitor on a state-by-state basis to calibrate their market sizing appropriately.

1) Pace of Legalization: Most analysts and industry observers anticipate somewhere between 35-45 states eventually legalizing sports betting. However, there is significant uncertainty on the time horizon for states to both pass legislation and implement processes for licensing sports betting operators once legalized. This legislative uncertainty translates to market sizing uncertainty, as the number of U.S. citizens able to easily access sports betting apps or facilities may be curtailed.

2) Digital Betting Restrictions: In the U.K., over 70% of sports betting happens online, and digital sportsbooks are anticipated to have a 10% CAGR over the next five years, comprising the majority of anticipated growth in the sector. Like so many consumer categories, the barriers to entry are significantly lower via ecommerce channels than requiring users to go to brick and mortar sites. The situation is decidedly different in the U.S. though, where only two-thirds of the states that have started permitting sports betting also allow digital sports betting. Further, The Wire Act is a federal law preventing interstate wagering, meaning that sports bettors can only place online bets if they are physically located within a state where it is legal to do so. While some sports bettors have doggedly persevered to drive across state borders to get their bets in, such regulations have surely limited the national market from reaching its full potential. The ability of the U.S. to hit a $25B+ market size seems dependent upon more liberal online betting laws to unlock the full growth that more mature markets are experiencing.

A secondary effect of digital betting restrictions is capping the growth of in-game betting. The U.S. market significantly lags behind more developed sports betting markets in terms of in-game betting options and functionality. In Europe, on average, 70-80% of the handle is generated via live betting during matches. This is in stark contrast to the ~20% generated in Nevada on average (Note: I was not able to identify New Jersey figures; if you have this info, feel free to ping me). Part of this lag is due to the restrictions on online betting, curtailing the addressable market for more sophisticated live betting products.

3) Online Skin & Licensing Rules: Even in states where online betting is permitted, there is another layer of restrictions around skins, and licensing rules developed largely as a concession to preexisting land-based casinos. While there are a number of different flavors, New Jersey’s model is a fair representation of where most states tend to be trending. Under New Jersey’s sports betting legislation, firms interested in becoming an online sportsbook must simultaneously enter into a commercial agreement with an existing land-based casino and seek licensing on their own as well as a digital sportsbook. The catch is that each land-based operator is only permitted 3 “skins”, or digital sportsbook partners limiting the size of the market. In other states, the limits are as low as 1 skin. These restrictions, while intended to protect the consumer, function to limit competition within certain markets, which may succeed in goosing revenue for particular firms but, in the long run, seems likely to reduce the total national market by reducing consumer choice and product innovation.

4) Legal Betting Age: While the above policy decisions are a bit more nebulous and harder to forecast out, one that seems more concrete regarding its impact on TAM is the legal betting age. In most states, the legal age for sports betting is 21, but a handful have started adjusting the age to 18. If that becomes the norm, over time, that could add $1B to the market size adjusting our assumptions from earlier (see Table 3 below).

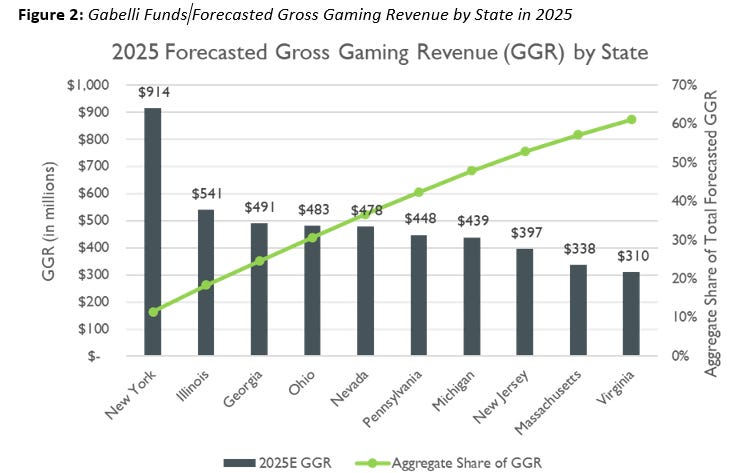

While I have not done the work to know on a granular state-by-state level how each of these regulatory considerations is likely to play out, Gabelli Funds has. I’ve included below a chart I built based on their state-by-state projections for 2025 forecasted gross gaming revenue. The two key insights here are 1) the top 10 states are likely to comprise ~60% of national revenue, and 2) the composition of those top 10 states does not include some notable markets such as California and Texas. While I’d encourage everyone to do their own research, if such key markets in the U.S. seem unlikely to pass meaningful sports betting legislation by 2025, the possibility of reaching the high cases in tables 2 and 3 seems that much more daunting.

Concluding Thoughts

The U.S. sports betting market is evolving quickly, and if the past 4+ years of change have proved anything, it is just how unpredictable American politics can be especially as states seek to recover from the Pandemic. With that being said, given the current sports-betting uptake rates within legal states, and legislative trends, the high end of estimates ($20B+) for the sports betting market feels a bit too rich for my blood. If and when the data changes though, I may also change my opinion. But for now, I’ll be monitoring GGR/adult in legal states and legislative trends throughout 2021 to see if the deck shakes out in favor of the sports betting bull thesis.

I hope this essay has equipped you with some useful frameworks for thinking about growth in sports betting, and, as always, please feel free to reach out with any thoughtful pushback, questions, or corrections. Thank you for reading!